We’re here to help make going to the doctor an easier process for you. This post walks you through the claims process. Please use this as a simple reference before your next doctor visit. Take a second to bookmark this post so you can get help with insurance claims and get on with your life.

THE IN-NETWORK CLAIMS PROCESS

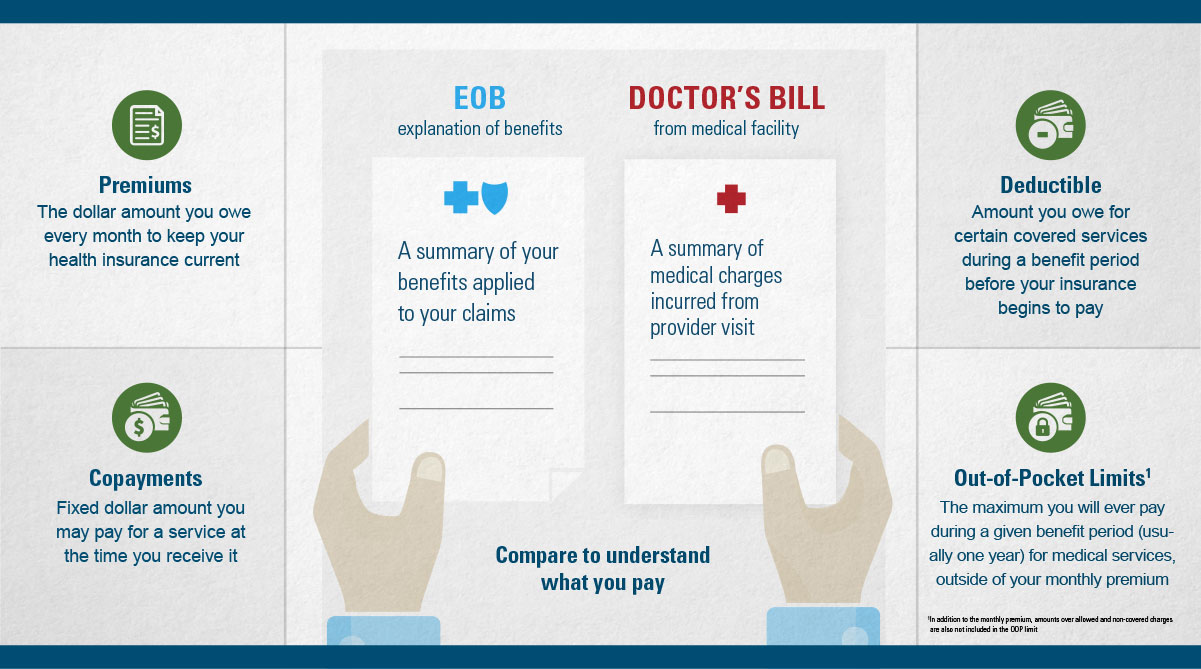

When visiting an in-network provider (doctor or hospital) make sure they verify your health insurance benefits, such as your co-pay, deductible, coinsurance and out of pocket expense. Don’t worry; this is typically a very quick and easy process.

Co-Payment:

If your plan requires a co-payment, it’s most often paid during the doctor visit. If you have to pay coinsurance, your doctor will likely send a bill after the visit.

Deductible:

If you haven’t met your deductible(s), you may have to pay something at the visit or when you get a bill in the mail from your doctor. You can easily view your deductible information at any time by logging onto Blue Connect. Please have your insurance card handy for logging on.

After your visit, you may receive an Explanation of Benefits (EOB). This is not a bill. This shows how much your plan paid and what you may owe for service(s).

The doctor or hospital will file the claim with us. The claim contains a lot of information including, but not limited to:

The doctor or hospital will file the claim with us. The claim contains a lot of information including, but not limited to:

- Policy owner

- Patient name

- Description of charges

Once we receive the claim, it’s reviewed to make sure your plan covers the medical services, and that the correct medical and billing codes were entered. We find out who needs to pay what amount and send payment to the doctor or hospital as needed.

Claims Process Time Line:

- Doctors and hospitals are required to file a claim within 180 days of a visit.

- Once we receive a claim, we have 30 days to review the claim and make a payment, deny payment or put the claim on hold for more information.

Note: The claims process may be delayed if we don’t get all of the information we need. For most doctors and hospitals, everything is filed correctly, and we can review the claim quickly.

THE OUT-OF NETWORK CLAIMS PROCESS

If you visit a doctor or hospital outside of a plan’s network, there are important differences you should know:

- There is no contract with the doctor or hospital, so you will most likely pay more.

- If prior approval is required and you don’t get it, you may be responsible for the entire bill.

- The doctor/hospital does not have to file a claim. If they don’t, you will need to file the claim .

- We send the claim payment directly to you.

- You must pay the doctor/hospital bill.

MAKING THE CLAIMS PROCESS WORK FOR YOU

Before each doctor visit review these four tips to understand your coverage and estimated costs:

- Know in advance, if your provider is in or out of network.

- Before scheduling a major surgery, make sure you know what is covered and the amount you are responsible to pay. You can do this by reviewing the benefit booklet in Blue Connect or call customer service with the number on the back of your ID card

- Make sure your doctor has the correct insurance information and bring your insurance card to every visit. If you lose your card, order a new one or print a temporary verification by logging onto Blue Connect.

- Keep good records of your care. Compare your medical bills to your EOBs.

We care about our customers and are here to help. In a rare instance that a claim is rejected, it may be for a variety of reasons, such as:

- Missing information from the provider

- Your plan doesn’t cover the procedure or prescription

- The procedure may be considered not medically necessary or experimental

Denied Claims

If your claim is denied, we encourage you to contact customer service to understand the concern and your options. If you disagree with the decision, you can ask for an appeal (a formal review). We’ll have our Appeals team take another look and gather more information from you and the provider to re-evaluate the decision.

ADDITIONAL RESOURCES

If you’re a current customer, be sure check out our Answer Spot website or download this intro guide for tips on getting care, managing your plan and how to stay healthy.

If you would like to speak to someone in person, try our retail stores or an agent near you.

Top Image by © Laura Doss/Corbis

ABOUT JAMES LACORTE

James LaCorte is a Social Media Manager and has been employed by Blue Cross North Carolina since 2003. He has built his career working in a variety of areas across the company. When not working you can find him kayaking a local river, photographing a nature scene, or running around with his family.